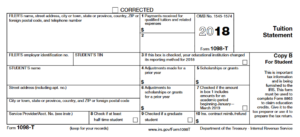

In previous years, the 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) the College billed to student accounts for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, the College will report in Box 1 the amount of QTRE paid during the year and Box 2 will be blank.

Students may be eligible for a federal education tax credit depending on:

- their income (or their family’s income, if they are a dependent).

- whether they were considered full or half-time enrolled.

- the amount of their qualified educational expenses for the year.

More detailed information about claiming education tax credits can be found in IRS Publication 970, page 9.

The dollar amounts reported on Form 1098-T may assist students in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of their tax return.

Muskegon Community College is unable to provide students with individual tax advice. Students should seek the counsel of an informed tax preparer or adviser if they have questions.

Below is a blank sample of the 2018 Form 1098-T, students will receive in January 2019, for your general reference. For more information about Form 1098-T, click here.